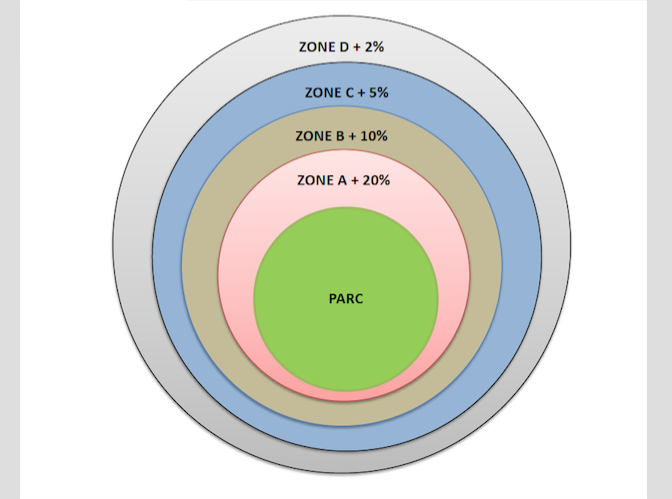

Last September, Louise Gratton, a consultant in ecology and conservation, presented a conference in Morin-Heights for the friends of Ruisseau Jackson. The conference was entitled “Conservation Options on Private Lands”. Ms Gratton introduced participants to the impact of parks and open spaces on property taxes, or, in other words, the impacts of protected natural areas on the value of adjacent properties.

The graph provided was requested by many!

As promised, we reproduce it for you here!

For those who want to know more, more information can be found in: The Economic Benefits of Land Conservation, The Trust for Public Land (2007), 54 pages.

Here is an excerpt from the report (p.1):

“(…) The proximate principle states that the market values of properties located near a park or open space (POS) frequently are higher than those of comparable properties located elsewhere. The higher value of these properties means that their owners pay higher property taxes. The increment of those taxes that is attributable to the POS may be used to retire bonds issued to acquire, develop, or renovate it. In some cases, the increment is sufficient to fully meet these debt charges.“

Please contact us should you need more information on the subject.

Louise Gratton woks as a consultant in ecology and conservation. She holds a master degree in biology and combines more than 35 years of experience in the field of ecology and nature conservation. She developed a strong expertise in surveys, protection, design and restauration of natural areas across Québec and worked 12 years for the Nature Conservancy of Canada (NCC).